Life is uncertain. Life insurance doesn’t have to be.

Budget-friendly 100% online life insurance designed for homeowners.

Protect your most valuable asset with mortgage protection insurance.

Buying a home is a huge step towards financial security and is one of the most important investments you will make in your lifetime.

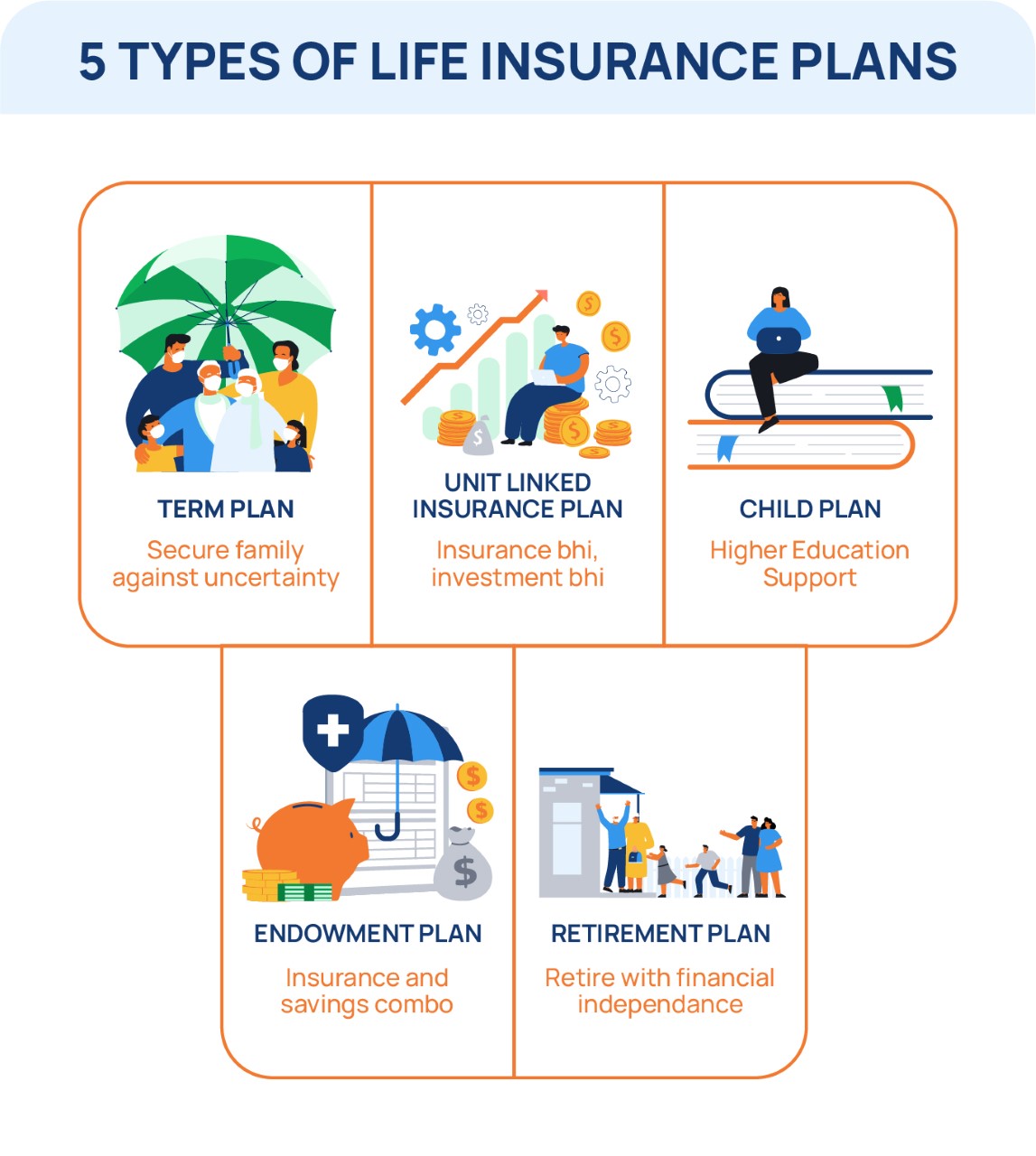

Mortgage protection insurance is an affordable term life insurance policy specifically designed for homeowners. Our policies ensure that your mortgage obligations are fulfilled if you cannot make payments due to a work accident, critical illness, disability or death.

Ensure that your loved ones can enjoy your home forever with mortgage protection insurance. You have enough to worry about. Let us check life insurance off your to-do list.

How It Works

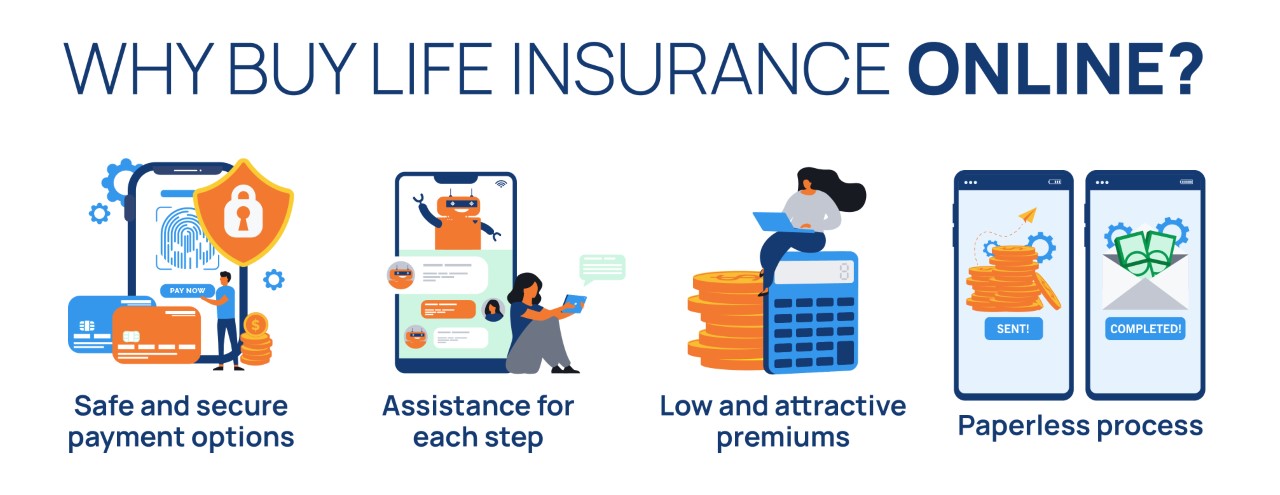

Choose between an online application or a consultation with a licensed agent.

Apply 100% Online

No need for an appointment. Get the

coverage you need in one place.

Receive Your Quote

Provide some basic information to get started.

Choose Your Policy

Get the coverage you need with no medical exam.*

Complete Your Application

It’s that simple.

Schedule Consultation

Speak to a licensed agent to get the coverage you want.

Receive Your Quote

Provide some basic information to get started.

Meet With Your Licensed Agent

A licensed agent will reach out to schedule a free consultation or policy review.

Get Covered

Your licensed agent will help you get the best coverage at the best price.

*Most individuals will qualify for life insurance coverage without the need for a medical exam.

We makes mortgage protection insurance simple.

Life insurance doesn’t have to be complicated. At Quility, we leave the decisions to you by offering mortgage protection insurance on your terms. And if you need any support along the way, our licensed agents are here to help.

Life is uncertain.

Life insurance doesn’t have to be.

Get Started