Our team works closely with you to understand your financial goals and design a mutual fund portfolio that balances growth, safety, and flexibility. Whether you are a beginner or an experienced investor, we provide a clear path to long-term wealth creation.

- Our Mission

We simplify mutual fund investing by educating you about fund types, returns, and risks, ensuring confidence at every step.

No financial jargon. We present mutual fund options in plain language so you can make informed decisions with ease.

We give you full control of your financial journey with actionable recommendations, regular portfolio reviews, and expert support.

- Our Capabilities

Tailoring plans using listed capabilities

Investment Planning

We evaluate your income, expenses, and goals to recommend the most suitable mutual fund categories—equity, debt, hybrid, or sector-based. Our aim is to align every investment with your risk profile and future needs.

Retirement Planning

We help you create a retirement corpus through carefully selected mutual funds, ensuring financial independence when you need it most.

Education Planning

We guide families in building a strong education fund for their children using SIPs and mutual funds, balancing safety and growth.

Our process

Getting to Know You

We start by understanding your financial goals—wealth creation, retirement, or children’s education—and defining the scope of planning.

Gaining Clarity on Your Finances

Our advisors assess your cash flow, assets, and liabilities to determine the right investment approach.

Building Your Financial Vision

We create a personalized mutual fund roadmap, projecting your potential wealth growth over time.

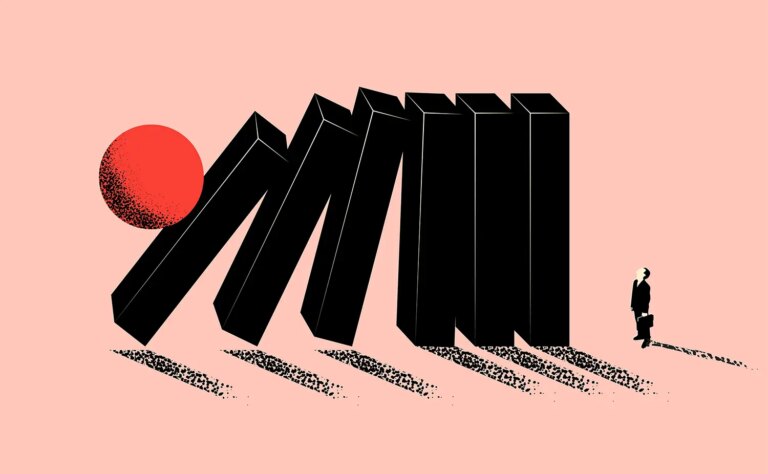

Analyzing Tradeoffs

Using data-driven insights, we explore fund options, compare scenarios, and finalize recommendations that balance growth with security.